Trump's Tariffs : Global Chaos or Local Justice ?

Navarro had predicted it, tariffs to save the people

In April 2025, Donald Trump relaunched an ambitious tariff policy: 10% on all imports into the United States, with rates of up to 49% for countries such as Thailand and Vietnam. This approach, aimed at reducing the trade deficit, repatriating industries and financing tax cuts, is part of a protectionist vision carried by Peter Navarro, his long-time economic adviser. Navarro, author of The Coming China Wars (2006) and Death by China (2011), has for decades defended the idea that globalization, dominated by unfair practices (Chinese subsidies, dumping), disadvantages the United States and its workers. For him, the tariffs are not an improvisation, but a mature response to an unbalanced system.

Beyond “America First”, Navarro and Trump place the “people first”, denouncing a globalized capitalism that ignores the suffering of the working classes. This strategy also attacks the hegemony of the dollar, weakened by the BRICS. A concrete example: since 2022, Russia has been selling oil to India in rubles and rupees, bypassing the dollar, a trend amplified by Western sanctions. For Navarro, the tariffs aim to slow this erosion by reducing dependence on imports, thus strengthening economic autonomy in the face of a changing world order.

Ricardo is crying, economists are panicking - free trade in danger?

Mainstream economists criticize this policy by relying on David Ricardo and his theory of comparative advantage, which advocates free trade to maximize global prosperity through specialization. Maurice Obstfeld, of the Peterson Institute, warns: “The tariffs have already been imposed, their threat effect has been exhausted, and they risk causing a global recession without achieving Trump's goals. Freya Beamish of TS Lombard adds: “These measures could weaken the dollar's position as a reserve currency, an outcome that few anticipate due to the lack of a viable alternative. While Takahide Kiuchi, of the Nomura Research Institute, adds: “Tariffs risk destroying the global free trade order established by the United States since World War II. »

These critics point to inflationary risks, disruption of supply chains and the inability to relocate massively in a context of near full employment. For many, Trump is acting irrationally, defying economic laws. “Who does he think he is to challenge a system that has created global prosperity? political and academic circles wonder.

However, an alternative reading allows us to see these tariffs as a weapon against disconnected global governance.

Tariffs, the lethal weapon to curb the world order

The tariffs could be a geopolitical response to the delay in peace talks in Ukraine, where some blame the Europeans – Macron and von der Leyen – for fuelling the conflict with Atlanticist posturing, prolonging tensions with Putin.

Emmanuel Macron called the tariffs “brutal and unfounded,” and von der Leyen warned that “uncertainty will spiral and trigger more protectionism.”

But Trump seems willing to sacrifice economic stability to impose his vision, using the “red button” on trade as a “lethal weapon” to force a re-examination of global priorities.

Apple relocates, the people toast, the true price of capital appears

This policy calls into question a financial system boosted by a global debt estimated at 318 trillion dollars and arbitrations favoring the elites. The cost of capital is broken down into: the cost of money (interest rates, cheap financing via debt), the cost of labor (wages, conditions), and logistical costs (transport, taxes). These costs are invoked at every turn to justify the various decisions of economic policies, as well as environmental choices on the climate narrative.

Large companies have exploited these gaps. Take Apple: via Foxconn in China, it assembles its iPhones with a labor cost of $2-3 per hour compared to $15-20 in the United States, taking advantage of low wages and precarious conditions. This arbitration reduces costs, but empties the United States, and other OECD countries, of industrial jobs, benefiting large groups capable of relocating, harming small local merchants competing with imported products at low prices. Trump's tariffs would be a response by seeking to reverse this, valuing local work and rebalancing power between multinationals and citizens.

Falling markets, waiting people - a forced realignment or recession?

The markets' reaction was immediate: the global stock markets, including the S&P 500, fell on April 3, 2025, all in the red and at the opening of the Asian markets today the same trend is on display. For critics, this is the prelude to a recession.

JUST IN - European stock markets crash at open. pic.twitter.com/qr2Iw3VBGx

— Disclose.tv (@disclosetv) April 7, 2025

However, a minority view sees this as a realignment with the real economy: markets overvalued by debt and speculation could refocus on tangible production. Barry Eichengreen of Berkeley notes, “If Trump grows impatient with the tariffs' failure to reduce the trade deficit, he may try even bolder ideas.” This shock could also limit the degrees of freedom of European governments, which are often accused of ignoring their people (LEZs, flouted referendums).

Constrained by budgets under pressure, they may have to rethink their priorities, especially on Ukraine, where their unlimited support – costly in money and credibility – would become untenable in the face of populations demanding more attention to local needs. This forced realignment could paradoxically restore popular sovereignty through economic coercion.

Green for the rich, red for reality - hypocrisy revealed

Financial markets are based on an entrenched hypocrisy: green (upside) is seen as good, a symbol of prosperity and confidence, while red (downside) is considered evil, a sign of chaos and failure. This simplistic dichotomy masks a reality: financial players had anticipated this risk. Navarro's ideas, which had been known for years, were valued by market participants and traders – the risk of a downside was in their models, as were Ferguson's estimates of excessive deaths in 2020 to push governments into lockdowns.

Since Trump's election in November 2024, the markets had climbed, driven by speculative optimism, but in a growing decorrelation with the real economy, harming the people. While traders lose their hair and their composure in the face of this fall, mainstream economists agree that this realignment will not benefit citizens, predicting inflation and job losses.

But another reading is possible: what if this correction brought the markets back to a more human scale, less dependent on debt-financed bubbles, giving the people a less virtual and more tangible economy? This vision, although in the minority, challenges the idea that only the increase benefits everyone.

Fewer iPhones, more freedom: the end of consumer drugs

Price increases due to tariffs (e.g., a more expensive iPhone) could encourage healthier consumption in the United States, away from the “drug” of overconsumption.

As I wrote in 2020 in “From global to local, around the globe in 80 quarters – a generation “, this return to the local is a response to an unsustainable globalization. And I added: “In the business world, when processes become obsolete, we launch a deep “Core Process Redesign” project where everything is allowed. We are not talking about social regression, but about societal progress towards a world where the rights of everyone respect our national motto of liberty, equality and fraternity. »

Consuming less would not be a loss, but a regained freedom, favouring sustainable and local goods over the “always more” financed by debt.

Backtracking is a move forward. The lesson of Coca-Cola

Coca-Cola exemplifies this principle. In 1985, New Coke was a fiasco; within three months, the company returned to Coca-Cola Classic, listening to its consumers. This reversion was common sense, not a failure. What if social progress – consumerism, financialization – had gone too far?

Going back, relocating, reducing dependence on imports, would be a real step forward: a balanced path for the majority, against elitist discrimination. Olaf Scholz, German Chancellor, calls for “flexing our muscles” to negotiate with Trump, is this really common sense? A voice perceived as a minority by the leaders, but very real among the citizens, sees in this confrontation a real opportunity to wake up the people.

Against the elites, for the people, tariffs as a cry for justice?

Trump's tariffs, although considered risky by elitist economists and politicians, could break a failing global governance, widening inequalities via debt and exploitation (China, BRICS). They challenge Ricardo to rebalance power between citizens and elites, valuing local work in the face of the arbitrations of multinationals.

The fall in the markets, perceived as an evil by financial hypocrisy, rising prices and a strategic reversion could refocus the economy on reality, giving people a voice in the face of indebted and disconnected governments – especially in Europe, where unconditional support for Ukraine could give way to priorities closer to the citizens. It remains to be seen whether this bold gamble will lead to chaos or renewal.

The chaos of some, the order of others. Proudhon laughs at the globalists

In the end, order is only an arrangement, a convention. The globalists have pushed their “new world order”, a borderless system where the only metrics are the cost of capital and profit, relegating the human being to the background. They dreamed of the advent of AI at the expense of humans, using the media to tout their strategy and defend their positions. What these elites call “chaos”—tariffs, falling markets—is just another arrangement, based on an objective function that does not suit them.

In fact, the times seem to prove Pierre-Joseph Proudhon, the anarchist thinker of the nineteenth century, right. He wrote in What is Property? (1840): “Property is theft”, denouncing the monopolization of wealth by a minority. In System of Economic Contradictions (1846), he added: “Political economy is the science of disorder,” criticizing a system that sacrifices equity for profit.

Trump's tariffs, by defying this artificial order, could paradoxically rehabilitate a social justice that Proudhon called for, giving back to humans their primacy over capital, a fictitious construction. If humans are superior, is it not through their ability to claim justice, a social contract, that matter – profits, markets – cannot offer?

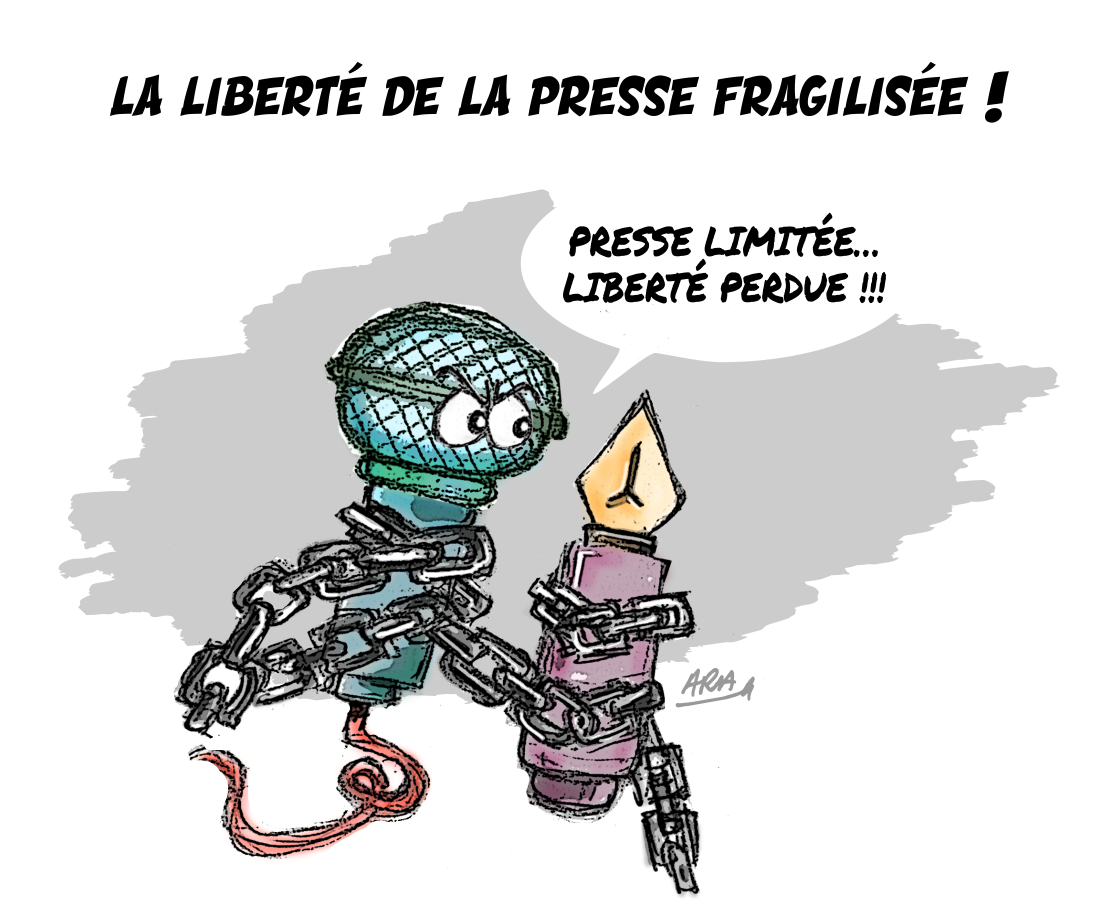

L'article vous a plu ? Il a mobilisé notre rédaction qui ne vit que de vos dons.

L'information a un coût, d'autant plus que la concurrence des rédactions subventionnées impose un surcroît de rigueur et de professionnalisme.

Avec votre soutien, France-Soir continuera à proposer ses articles gratuitement car nous pensons que tout le monde doit avoir accès à une information libre et indépendante pour se forger sa propre opinion.

Vous êtes la condition sine qua non à notre existence, soutenez-nous pour que France-Soir demeure le média français qui fait s’exprimer les plus légitimes.

Si vous le pouvez, soutenez-nous mensuellement, à partir de seulement 1€. Votre impact en faveur d’une presse libre n’en sera que plus fort. Merci.

Je fais un don

Je fais un don